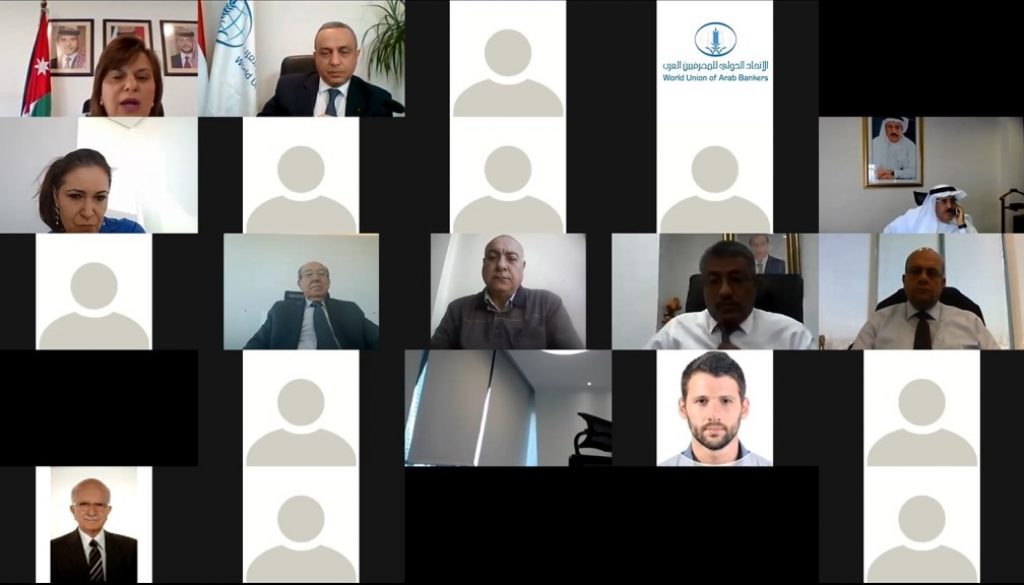

The World Union of Arab Bankers (WUAB) organized on the 15th of April, 2021 the “First Banking Executive Online Conference 2021” via visual communication technology.

The Conference which serves as a platform of communication among active people in the field, was attended by more than 120 participants from Arab Banks, financial institutions, Arab banking and financial organizations, unions and NGOs, as well as diplomatic, governmental and political personnel.

Among the prominent participants were Dr. Joseph Torbey, Chairman, World Union of Arab Bankers, and Chairman of the Executive Committee, Union of Arab Banks, Mr. Adnan Ahmed Yousif, Chairman of Bahrain Association of Banks, Mr. Mohamed El-Etreby, Federation of Egyptian Banks (FEB), H.E. Mr. Marwan Hamadeh, H.E Ms. Kholoud M. Saqqaf, CEO, Social Security Investment Fund –Jordan, H.E. Dr. Imad Boukhamseen, Board Member at the Union of Arab Banks (UAB), H.E. Dr. Mohammed Ben Omar, Secretary-General of the Arab organization of Information and Communication Technologies (ICT)

Conference Overview

I. The State of the World Economy

A stronger starting point for the 2021–22 forecast.

Multiple vaccine approvals and the launch of vaccination in some countries in December have raised hopes of an eventual end to the pandemic.

Three questions. These developments raise three interrelated questions for the global outlook.

- How will restrictions needed to curb transmission affect activity in the near term before vaccines begin delivering effective society-wide protection?

- How will vaccine-rollout expectations and policy support affect activity?

- How will financial conditions and commodity prices evolve?

- Fiscal policy support set to boost economic activity.

- Supportive financial conditions. Major central banks are assumed to maintain their current policy rate settings throughout the forecast horizon to the end of 2022.

- Rising commodity prices.

Risks of the Outlook

Although new restrictions following the surge in infections suggest growth could be weaker than projected in early 2021, other factors pull the distribution of risks in the opposite direction.

- On the upside, further favourable news on vaccine manufacture (including on those under development in emerging market economies), distribution, and effectiveness of therapies could increase expectations of a faster end to the pandemic than assumed in the baseline, boosting confidence among firms and households.

- On the downside, growth could turn out weaker than in the baseline if the virus surge (including from new variants) proves difficult to contain, infections and deaths mount rapidly before vaccines are widely available, and voluntary distancing or lockdowns prove stronger than anticipated. Slower-than-anticipated progress on medical interventions could dampen hopes of a relatively quick exit from the pandemic and weaken confidence.

II. Digital Transformation

Digital transformation is the integration of digital technology into all areas of a business, fundamentally changing how we operate and deliver value to customers. It’s also a cultural change that requires organizations to continually challenge the status quo, experiment, and get comfortable with failure.

The four domains in Digital Transformation.

- Technology From the Internet of Things, to blockchain, to data lakes, to artificial intelligence, the raw potential of emerging technologies is staggering. And while many of these are becoming easier to use, understanding how any particular technology contributes to transformational opportunity, adapting that technology to the specific needs of the business, and integrating it with existing systems is extremely complex.

- Data The unfortunate reality is that at many companies today most data is not up to basic standards, and the rigors of transformation require much better data quality and analytics. Transformation almost certainly involves understanding new types of unstructured data (e.g., a driver-supplied picture of damage to a car), massive quantities of data external to your company, leveraging proprietary data, and integrating everything together, all while shedding enormous quantities of data that have never been (and never will be) used.

- Process Transformation requires an end-to-end mindset, a rethinking of ways to meet customer needs, seamless connection of work activities, and the ability to manage across silos going forward.

- Organizational Change Capability In this domain we include leadership, teamwork, courage, emotional intelligence, and other elements of change management.

Pulling It All Together So far, we’ve discussed the technology, data, process, and organizational change capability domains as if they existed in isolation, which of course they don’t. Rather, they are part of a larger whole. Technology is the engine of digital transformation, data is the fuel, process is the guidance system, and organizational change capability is the landing gear. You need them all, and they must function well together. Finally, work on technology, data, and process must proceed in an appropriate sequence. It is generally accepted that there is no sense automating a process that doesn’t work, so in many cases, process improvement or reengineering must come first.

Five Key Lessons:

- Figure out your business strategy before you invest in anything. Leaders who aim to enhance organizational performance through the use of digital technologies often have a specific tool in mind. “Our organization needs a machine learning strategy,” perhaps. But digital transformation should be guided by the broader business strategy.

- Leverage insiders. Organizations that seek transformations (digital and otherwise) frequently bring in an army of outside consultants who tend to apply one-size-fits-all solutions in the name of “best practices.” Rely instead on insiders — staff who have intimate knowledge about what works and what doesn’t in their daily operations.

- Design customer experience from the outside in. If the goal of DT is to improve customer satisfaction and intimacy, then any effort must be preceded by a diagnostic phase with in-depth input from customers.

- Recognize employees’ fear of being replaced. When employees perceive that digital transformation could threaten their jobs, they may consciously or unconsciously resist the changes. If the digital transformation then turns out to be ineffective, management will eventually abandon the effort and their jobs will be saved (or so the thinking goes). It is critical for leaders to recognize those fears and to emphasize that the digital transformation process is an opportunity for employees to upgrade their expertise to suit the marketplace of the future.

- Bring Silicon Valley start-up culture inside. Silicon Valley start-ups are known for their agile decision making, rapid prototyping and flat structures. The process of digital transformation is inherently uncertain: changes need to be made provisionally and then adjusted; decisions need to be made quickly; and groups from all over the organization need to get involved.

III. Laws and Regulations

- Regulation is rising on the risk radar

- Regulating Financial Risks

- Regulating Non-Financial Risks

- AML Regulations

- Financial Reporting

- Laws and Regulations and the cost of Compliance

- Laws and Regulations in the Digital Age

- Laws and Regulations and the Competitive Environment

- Laws and Regulations and the cost of operations.

Conference Proceedings

Inauguration

On Thursday April 15th, 2021 at 11:00 Beirut time, the “First Banking Executive Online Conference 2021” commenced by an introductory video about the World Union of Arab Banks.

Mr. Wissam H. Fattouh, Secretary General, Union of Arab Banks and World Union of Arab Banker welcomed the participants in his inauguration speech and explained the importance of the conference and the role it aims to play as a platform to share and exchange knowledge and discuss the latest developments the economy and banking sector is witnessing.

Dr. Joseph Torbey, Chairman, World Union of Arab Bankers, and Chairman of the Executive Committee, Union of Arab Banks, had a welcome speech, greeting the participants and highlighting the main effects and repercussions of Covid-19 pandemic on the global economy and the economies of the MENA region. Dr. Torbey then discussed the status of digital transformation and the huge leaps it has achieved especially during the pandemic and role it is playing in financial inclusion. However, Dr. Torbey emphasized that laws and regulation should develop rapidly to keep up the pace with the advancements in financial technology therefore creating opportunities to banks, supervisory bodies and clients as well.

Sessions

World Economy amidst the Pandemic

- H.E. Mrs Kholoud El-Saqqaf, Chairman, Social Security Investment Fund – Jordan

Digital Transformation – Roadmap to Implementation

- Dr. Leila Dagher, Associate Professor of Economics and the Director of the Institute of Financial Economics, American University of Beirut (AUB)

- Dr. Mohammad Fheili, Risk Strategist and Capacity Building Expert

Modernization of Financial Laws and Regulations

- Mr. Chahdan E. Jebeyli, Group Chief Legal & Compliance Officer, Bank Audi Group

- Dr. Mohamad Hussein Mansour, Consultant at the World Bank Group, Director of the European Middle East Institute for Research, Lecturer at AUB and LAU