To mitigate recent economic losses in developing nations, it will be essential to increase people’s access to finance, lower the cost of digital transactions, and route wage payments and social transfers through financial accounts. There are various ways that governments and the corporate sector can support this shift.

The poor are suffering the most globally due to rising inflation, limited economic growth, and food shortages. In addition to the COVID-19 pandemic’s unequal consequences, today’s numerous crises have already resulted in catastrophic development reversals and an enormous rise in worldwide poverty.

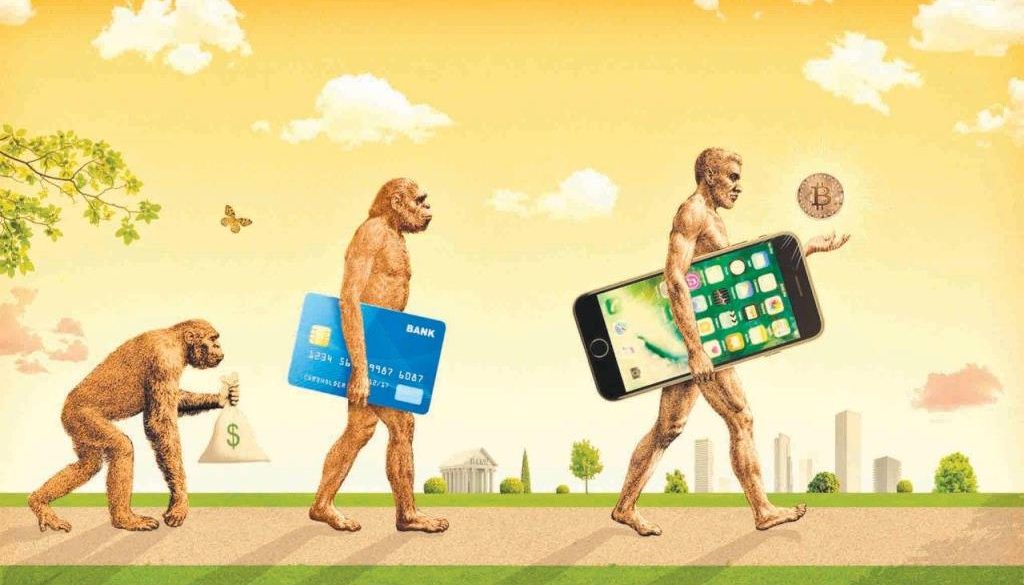

Positively, the COVID-19 crisis sparked unheard-of change, particularly in sectors with a significant digital component. This digital revolution has changed how people send and receive payments, borrow money, and save money through increasing access to and use of financial services in developing economies.

The most recent Global Findex database, which was created using data from a poll of more than 125,000 adults in 123 economies and covers the use of financial services in 2021, glaringly shows these shifts. In comparison to 42 percent in the first edition of the database published ten years ago, the survey found that 71 percent of adults in developing economies now have a formal financial account, whether it be with a bank, another regulated institution like a credit union or microlender, or a mobile money service provider. Additionally, the gap between the percentage of men and women who own accounts in developing nations has shrunk for the first time, from nine percentage points to six.

With the help of this digital change, it is now simpler, less expensive, and safer for people to receive paychecks from their companies, remit money to loved ones, and make purchases. High volume, small value transactions, which enable users to access financial services and save money for better crisis management, can be handled more easily via mobile money accounts. Additionally, women have more privacy, security, and financial management thanks to individual accounts.

From 35% in 2014 to 57% in 2021, the proportion of adults in developing economies that send or receive digital payments increased. 39 percent of mobile money users in Sub-Saharan Africa currently utilize their accounts to save money. And after the COVID-19 pandemic began, more than one-third of consumers in low- and middle-income nations who paid an energy bill from an account done so for the first time.

As money moves from a government’s budget to public agencies and then to citizens, the digital revolution is important because it helps to promote transparency. By sending transfers straight to their beneficiaries’ cell phones, government social programs can now cut down on delays and leakage. During the epidemic, millions of people in underdeveloped nations got compensation in this manner, reducing the impact of COVID-19 on their standard of living.

It is imperative to build on these optimistic developments, especially in light of the current economic challenges. To minimize development setbacks brought on by the ongoing volatility, it will be essential to increase people’s access to finance, lower the cost of digital transactions, and route wage payments and social transfers through financial accounts.

In a number of crucial areas, both the public and commercial sectors can help this transformation move forward. They must first establish a supportive operating and policy environment. For instance, providing system interoperability permits payments across various financial institutions and mobile money service providers. The mobile phone system is far more important to improving access to finance than the traditional banking system. Internet access that is both functional and inexpensive is a requirement for developing digital finance. Stable laws and consumer protections are also required to promote ethical business practices that increase confidence in the financial system.

Establishing digital identification systems is necessary as well because one of the main reasons some adults continue to be denied access to financial services is a lack of a recognized identity. We are aware from the experiences of nations like India and the Philippines that government identification initiatives and financial inclusion programs can collaborate to provide formal identification documents and bank accounts to hard-to-reach people. For instance, India was a pioneer in developing a user-friendly digital ID system that prioritizes privacy and security.

It should also be a top priority to encourage the digitalization of payments. 865 million account holders in emerging economies opened their first account at a bank or other financial institution in order to get money from the government, according to the Global Findex data for 2021. Because customers who received payments into an account were more inclined to utilize their account to make payments and access other services, this benefited households directly and also contributed to the development of the digital financial ecosystem. Thus, digital payments made by governments provide as a base for building trustworthy social registers and locating gaps and overlaps.

As digital payments become more widespread and less costly, many private businesses will be able to pay their workers and suppliers electronically – and should. The digital revolution offers a chance to increase formal-sector employment without making compliance excessively burdensome. At a time of tighter government budget constraints, digital payments can help broaden the revenue base by reducing tax avoidance and evasion.

Finally, policymakers will need to make additional efforts to include underserved groups. The gender gap in financial access has narrowed, but it still exists. Women, along with the poor, are more likely to lack a form of personal identification or a mobile phone, to live far from a bank branch, and to need support to open and use a financial account. Financial-education programs, especially those that involve peer-to-peer learning (such as through women’s self-help groups) are essential as well.

The World Bank is firmly committed to expanding financial inclusion through digitalization. We will continue to support countries as they enhance mobile-phone networks, rework regulations to foster access to finance, adopt e-government platforms, and modernize social-protection systems. For the many millions of people who still lack an account, we need to redouble our efforts and find creative ways to connect them to the financial system, build economic resilience, and reap the benefits of inclusion.