BY DR SOHA MAAD

Introduction

The recent European Union Elections in June 2024 had a great impact on global markets including the Eurobond market. This article presents an overview of Eurobonds covering benefits, risks, types, regulations, markets and history of Eurobonds. The article sheds light on the latest development in the global Eurobond market. The size of the EU bond market is analysed. Eurobonds issued by Saudi Arabia, Qatar, United Arab Emirates and Lebanon are examined. The impact of the European Union EU 2024 election on the Eurobond market is assessed with an outlook on EU digital future towards financing defence technologies and the rise of EU defence Eurobonds. The article concludes with recommendations for Arab investors and issuers of Eurobonds.

Overview of Eurobonds

Eurobond is a type of bond that is issued in a currency that is different from the currency of the country where it is issued. These bonds are typically issued by multinational corporations or governments and are denominated in a currency other than the one in which they are issued.

Eurobonds are typically issued in the international market and are not subject to the regulations of any single country. This allows issuers to access a larger pool of investors and potentially lower borrowing costs. Eurobonds are usually issued in large denominations and have maturities ranging from a few years to several decades.

Benefits of Eurobonds. One of the main benefits of Eurobonds is that they allow issuers to diversify their sources of funding and access a wider range of investors. Eurobonds also provide investors with the opportunity to invest in different currencies and markets, which can help to spread risk.

Risks of Eurobonds. While Eurobonds can offer benefits in terms of diversification and access to a larger investor base, they also come with risks. These risks can include currency risk, interest rate risk, and political risk, among others. Investors should carefully consider these risks before investing in Eurobonds.

Types of Eurobonds. There are several different types of Eurobonds, including fixed-rate bonds, floating-rate bonds, zero-coupon bonds, and convertible bonds. Each type of Eurobond has its own unique features and characteristics, so investors should carefully consider their investment objectives and risk tolerance before investing in any particular type of Eurobond.

Market for Eurobonds. The market for Eurobonds is a global market, with bonds being issued and traded in various financial centers around the world. The Eurobond market is known for its liquidity and depth, making it an attractive option for both issuers and investors looking to access the international capital markets.

Regulation of Eurobonds. Eurobonds are typically not subject to the same regulations as domestic bonds, as they are issued in the international market. This can make Eurobonds an attractive option for issuers looking to raise capital without being subject to the regulatory requirements of a particular country.

History of Eurobond Market

The Eurobond market began with the Autostrade issue for the Italian motorway network in July 1963. It was for United States US$15m with a 15 year final maturity and an annual coupon of 5½%. The cross-border debt capital market continues to bring together borrowers and investors from all over the world and meets the funding needs of countries, supranational organisations, financial institutions and companies.

History of the Eurobond Market

Source: International Capital Market Association ICMA

1963 First Fixed rate issue: Autostrade 1969 Launch of Association of International Bond Dealers (AIBD) 1969 Launch of Euromoney 1969 Euro-clear established (forerunner of Euroclear) 1970 Cedel established (forerunner of Clearstream) 1970 First Floating Rate Note: ENEL 1979 First bought deal: GMAC 1981 First swap: IBM/IBRD 1989 Fixed price reoffer introduced 1989 First global bond: World Bank 1992 Association of International Bond Dealers (AIBD) changes name to International Securities Market Association (ISMA) 1994 First CDS: Exxon/EBRD 1999 Pot deal introduced 1999 Euro introduced in 12 countries forming the Eurozone 2005 International Securities Market Association (ISMA) and International Primary Market Assocation (IPMA) merge to form International Capital Market Association (ICMA) 2007 Global credit crisis starts 2008 Lehman’s default 2010 European sovereign debt crisis starts 2013 50th Anniversary of the Eurobond Market |

Bond Market Size

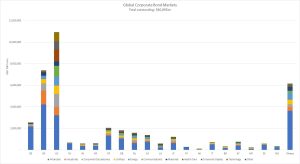

The International Capital Market Association ICMA estimates that the overall size of the global bond markets in terms of USD equivalent notional outstanding, is approximately $128.3tn. This consists of $87.5tn SSA bonds (68%) and $40.9tn corporate bonds (32%).

In terms of country of incorporation, the global corporate bond markets are dominated by the US ($10.9tn) and China ($7.4tn). Between them they make up 45% of the total global corporate bond market. 53% ($21.5tn) of outstanding corporate bonds are issued by financial institutions.

Global Corporate Bond Markets

Source: ICMA analysis using Bloomberg Data (August 2020)

|

Size of EU Bond Market

The EU bond market encompasses debt securities issued by European Union member states. The EU bond market includes bonds issued by individual member countries, as well as bonds issued by EU institutions like the European Commission. These bonds serve different purposes, such as funding government expenditures, infrastructure projects, or policy programs. The European Commission, acting as the EU borrower, has a strong track record of successful bond issuances over the past 40 years. All EU bonds are denominated exclusively in euros. The proceeds from these issuances fund EU policy programs. EU bonds generally have low default risk and high liquidity. However, due to the varying economic strength of the 27 member states, yields and other bond characteristics can differ significantly. Investors should consider these factors when making informed decisions.

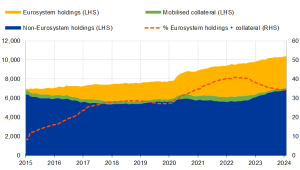

Since mid-2022 the Eurosystem’s balance sheet declined by around €2,000 billion, or more than 22 per cent. The largest part of this decline is due to banks having repaid a substantial share of the loans taken from the Eurosystem via the targeted long-term refinancing operations. This has released many assets previously used as collateral back to the market, including government bonds. Moreover, the Eurosystem owns smaller amounts of bonds since it no longer reinvests maturing bonds under its asset purchase programme.

The reduction of the Eurosystem’s balance sheet and the fact that governments across the euro area have issued record amounts of debt have substantially increased the availability of bonds to the market. This has helped to bring the Eurosystem’s footprint in government bond markets closer to pre-pandemic levels.

Size of euro area government bond market and the Eurosystem market footprint (EUR billions and %)

Sources: Eurosystem, The Centralised Securities Database (CSDB)

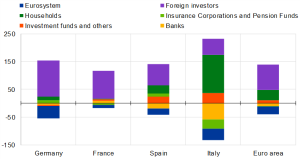

Various types of investors have stepped in and compensated for the Eurosystem’s reduced presence. While the Eurosystem has not actively sold bonds, it only partially replaced maturing bonds in its monetary policy portfolios. Two sectors have clearly contributed the most to absorbing the new debt since the Eurosystem began to reduce its balance sheet: households and foreign investors.

Sectoral absorption of government securities in 2023 (%)

Sources: European Central Bank

|

Saudi Arabia Eurobonds

Saudi Arabia sold $10 billion of dollar Eurobonds in three parts in January 2023. The deal was priced with the notes to yield 110 and 140 basis points over Treasuries.

The kingdom attracted over $35 billion of investor orders for the notes maturing in five, 10.5 and 30 years as it seeks to take advantage of cooling inflation. Saudi Arabia run a surplus of 16 billion riyals ($4.3 billion) in 2023.

Qatar Eurobonds

Qatar is selling its first dollar Eurobonds in four years and its debut green deal, as one of the world’s largest liquefied natural gas exporters seeks to tap into a booming global market for sustainable debt. The government is selling green bonds with maturities of five and 10 years. Initial spread guidance is 70 basis points over United States US Treasuries for the short tranche and 80 basis points for the longer one.

United Arab Emirates Eurobonds

In April 2024, Abu Dhabi is selling its first Eurobonds since 2021. The oil-rich emirate, rated AA by all three major ratings companies, is issuing the Eurobond dollar deal with tranches of five, 10 and 30 years. The five year portion has initial spread guidance of around 70 basis points of US Treasuries, while the 10-year debt has guidance of 85 basis points and the longest tranche 125 basis points. Abu Dhabi Commercial Bank PJSC, Citigroup Inc., First Abu Dhabi Bank PJSC, HSBC Holdings Plc, JPMorgan Chase & Co., Morgan Stanley and Standard Chartered Plc are managing the bond sale.

Lebanon Eurobonds and the Financial Crisis

Lebanon has long relied on issuing dollar-denominated Eurobonds, whenever the state needed financing.

These bonds reached a peak in March 2020 when the government announced a default on payment, totaling $31 billion, including $11 billion owed to foreign bondholders.

This figure increased as domestic holders, particularly banks, bought bonds, bringing the total owed to foreign creditors to $16 billion, hoping to profit from the Eurobond price increase if reforms are implemented and an agreement is reached with the International Monetary Fund (IMF).

In Lebanon, the risks incurred by the state and Banque du Liban (BDL) in connection with the Eurobonds on which Lebanon defaulted in March 2020 are high. The risk of legal action by holders of Lebanon Eurobonds is increasing. Since Lebanon defaulted, the holders of Eurobonds have a straightforward debt claim against the state for non-payment.

Impact Of EU Election On Eurobond Market

French bonds and bank stocks were rocked by political turmoil following European Union Election in June 2024. French markets endured another brutal sell-off as political uncertainty unleashed the biggest jump in the premium investors demand to hold French government debt since 2011 and bank stocks tumbled.

France’s Finance Minister Bruno Le Maire warned the euro zone’s second-biggest economy faced the risk of a financial crisis with the far right winning of parliamentary.

French banks were hit hard. The country’s biggest three banks, BNP Paribas, Credit Agricole and Societe Generale, have lost between 12-16% in value, the highest loss since the banking crisis of March 2023.

The recent European parliamentary elections have brought despair for some parties after a substantial shift to the right shook the political foundations of the European Union. A stunning defeat of the Green Party, which had performed so well in the 2019 elections, also shows European voters’ declining enthusiasm for the Green Deal and other climate policies.

Fundamentally, the center right and far right achieved significant victories in EU Elections and this will shape European policy for the coming five-year term.

It is worth mentioning that the EU is the second-largest economy globally in nominal terms (after the US) and third-largest by purchasing power parity (after China and the US). Its GDP in 2024 is approximately $18.98 trillion (nominal) and $26.64 trillion (PPP). Key sectors include services (70.7%), industry (24.5%), and agriculture (1.5%). Exports and imports play a crucial role, with major trading partners like the United States US, China, and the United Kingdom UK.

EU Digital Future towards Financing Defence Technologies

To move away from a technosolutionist approach, it is important to envision a future where technology serves humanity, democracy, and the planet. The European elections in 2024 raised concerns over the continuous progression of the far-right within EU democratic institutions. With over twenty years of experience advocating for a free, fair, and open digital environment in Europe, a shift to the right poses a grave threat to Europe fundamental rights.

Looking ahead to the next mandate of EU institutions, there is anticipation of a rise in the market dominance of large tech corporations and the implementation of draconian state surveillance practices.

Much discussion surrounding the elections has focused on how technology could potentially address complex sociopolitical issues such as climate change, job insecurity, and the militarisation of public spaces. Technology is seen as the fastest route to profit and growth, yet its social and environmental impacts are ignored. In light of the European elections, the conservative majority forming the new European Parliament is expected to prioritise backing defence technology, especially for immigration and border control.

This will be manifested in the political push for age verification, undermining encryption, and the mass surveillance of digital lives.

Defence Eurobond Rising

During the eurozone crisis, the EU created a legal instrument, the European Financial Stability Facility. This allowed to issue bonds with a lending capacity of €440 billion.

With the COVID pandemic, this was repeated as the EU adopted a recovery fund with a firepower of €750 billion, financed through common debt issuance.

The same line of thinking has inspired EU politicians to issue defence bonds – to finance a major boost of the EU’s defence capabilities. Estonia’s Prime Minister Kaja Kallas highlighted in December 2023 the need for EU defence bonds to fight Russia’s aggression in Ukraine. The European Council President Charles Michel suggested that the EU should consider ‘European defence bonds’ to fund investment in European defence and security as part of a new push for deeper military coordination.

Speaking at the European Defence Agency annual conference on 30 November 2023, the European Council President said EU member states should pool what could amount to €600 billion in defence investment over the next 10 years. He also pointed out that European defence bonds would be an attractive asset class, including for retail investors.

Road Ahead For Arab Investors and Issuers of Eurobonds

In light of the above overview of Eurobonds and Eurobonds global market, we give the following recommendations for Arab investors and issuers of Eurobonds:

Recommendation #1. Beware of political uncertainties following EU elections

Political uncertainties are set to continue driving market volatility in Europe amid the surprising outcome of the French election. The split of political powers will cast increasing uncertainties on critical policies, particularly in government finance.

Recommendation #2. Choosing the right Eurobond currency

The euro currency swings amid political uncertainties. The euro weakened significantly against other Group of ten G-10 currencies in early June 2024 when French President Emmanuel Macron called for a snap election after the far-right party leader. The single currency fell as much as 2% against the United States US dollar to 1.0664 in the second half of June 2024. Recent election result put pressure on the euro again.

Recommendation #3. Analysing market sentiment

The resilient movement in the euro following EU 2024 elections is key to driving market sentiment.

Recommendation #4. Watching inflation

Investors are closely monitoring the market reactions to the French election in Europe. Additionally, both China and the United States US are set to release their Consumer Price Index (CPI) data, providing insights into the inflation trajectory of the world’s two largest economies. It is hard to predict the long term impact of EU election on inflation, but it is certain that political turmoil will have a long term impact on inflation and currencies in which Eurobonds are issued.

Recommendation #5. Assessing investment risk

The European stock markets experienced a sharp selloff after the first round of the French election. The risk premium on the French debt, measured by the 10-year government bond yields, retreated to 3.21% after reaching an eight-month high of 3.37% earlier. Meantime, the hardest-hit sectors such as banking stocks and green energy shares saw the sharpest rebound.