Transparency, Innovation, and Resilience: Inside Banque de l’Habitat’s Journey

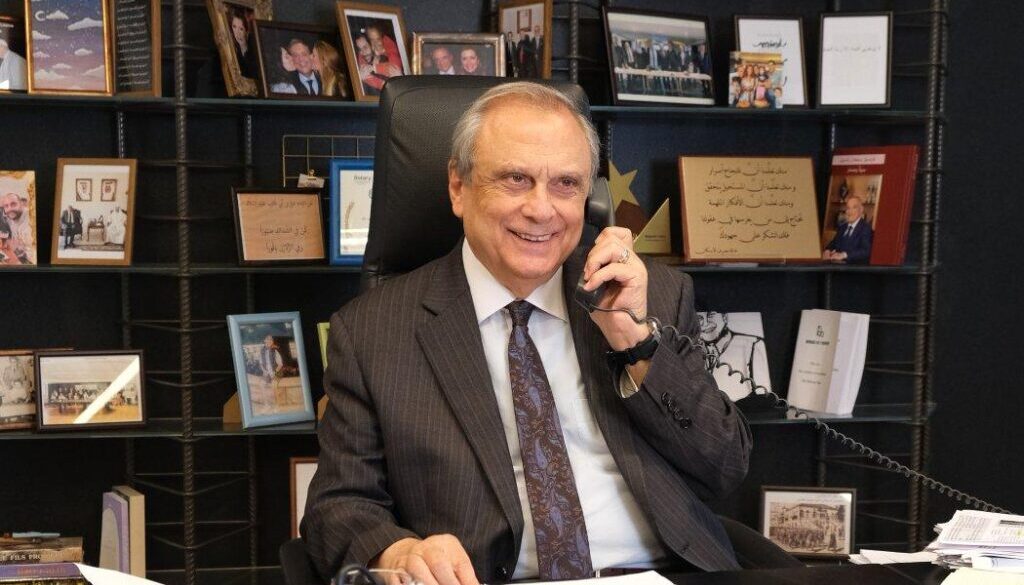

Chairman Antoine Habib reveals how the bank maintains credibility and secures funding in challenging times.

How do you evaluate Banque de l’Habitat’s role in fulfilling its commitments despite economic challenges?

Banque de l’Habitat has always been a model of commitment, staying true to the principle that “a promise is a debt of honor.” Since I were elected in 2022 to lead this institution, I have maintained a strategic goal of facilitating access to decent housing for families with low and middle incomes. Despite the economic difficulties, we explored various funding sources, both local and international, in collaboration with Arab, European, and international organizations.

Although initial efforts faced skepticism, we tackled challenges with determination and resilience. Banque de l’Habitat not only honored its commitments but also successfully dispelled doubts, solidifying its position as a reliable institution capable of overcoming crises. The bank has proven that challenges can be transformed into opportunities for growth and development, reinforcing its credibility and flexibility in effectively supporting the Lebanese community.

Can you share the details of Banque de l’Habitat’s collaboration with the Arab Fund for Economic and Social Development?

In 2023, at the invitation of Engineer Nabil Al-Jisr, Chairman of the Council for Development and Reconstruction (CDR), we participated in a meeting with a delegation from the Arab Fund for Economic and Social Development at the council’s headquarters. During this meeting, we presented a comprehensive report on the financial and administrative status of Banque de l’Habitat and renewed our request to reactivate a loan granted in 2019, which remains pending.

This meeting was characterized by transparency and positivity, allowing us to emphasize our strict adherence to financial management standards and reaffirm that Banque de l’Habitat has always honored its financial obligations to Arab funds and other institutions. The Arab Fund delegation also evaluated the bank’s assets, noting that all our branches across Lebanon are fully owned, which is a strategic advantage that strengthens the bank’s stability and sustainability.

It is important to acknowledge the visionary leadership of former General Manager Mr. Joseph Sassine, who spearheaded the acquisition of all bank branches. This achievement facilitated a thorough financial due diligence process, which confirmed the bank’s robust financial standing. Under Mr. Sassine’s leadership, successive boards meticulously fulfilled all financial obligations, including the repayment of borrowed capital and interest owed to donors. This financial discipline was pivotal in securing the Arab Fund loan in 2019.

Today, the current administration remains committed to the same prudent approach, guided by strong governance policies that ensure stability and sustainable growth for the bank.

What were the outcomes of the official mission to Kuwait and your meeting with the Arab Fund for Economic and Social Development?

During an official mission to Kuwait, we met with representatives of the Arab Fund for Economic and Social Development. The primary objective of the meeting was to finalize the disbursement of the second installment of the loan, valued at USD 16.3 million, aimed at supporting families with low and middle incomes. The Arab Fund confirmed that the installment would be transferred to our account upon receiving the official request, which was completed by the end of November 2024.

Adapting to the current economic conditions, the loan currency was converted from Lebanese Lira to US Dollars and will be disbursed over ten equal installments within five years, at an interest rate of 6%. This funding is a cornerstone of financial stability and allows Banque de l’Habitat to continue supporting Lebanese citizens seeking to own homes, reaffirming the bank’s ability to uphold its mission even amidst crises.

How has the new electronic platform simplified and streamlined the loan application process?

We launched an innovative electronic platform designed to simplify administrative procedures and make the loan application process more accessible for borrowers. Through this platform, Lebanese citizens, regardless of location, can submit their applications online with ease, receive immediate feedback on eligibility, and finalize procedures at the nearest bank branch. This initiative reflects our commitment to offering more efficient and transparent services that align with the evolving needs of our clients.

Are the current financial resources sufficient to meet citizens’ needs?

While current funding sources are limited, they are primarily allocated to support the purchase, construction, or renovation of housing in rural areas outside the capital, Beirut. This support aims to reduce rural-to-urban migration and encourage Lebanese citizens to remain in their hometowns, in line with the vision of late Presidents Salim Al-Hoss and Elias Sarkis, who established Banque de l’Habitat in 1977. Their vision sought to preserve Lebanon’s social fabric and promote local stability.

However, the available funds, totaling USD 165 million, are insufficient to meet the growing demand. To bridge this gap, we requested additional financing from international institutions, such as the Abu Dhabi Fund for Development and the Kuwait Fund for Arab Economic Development. The Lebanese Council of Ministers tasked the Council for Development and Reconstruction (CDR) with negotiating these loans to secure the necessary resources, ensuring sustained support for citizens and fostering sustainable development.

What strategies does Banque de l’Habitat employ to ensure the sustainability of new funding sources, both local and international?

Banque de l’Habitat follows a comprehensive and diversified strategy to secure sustainable financial resources by enhancing funding at the local, regional, and international levels. Domestically, the bank relies on certificates of deposit as a key funding source, supported by legislative initiatives such as Decree No. 9812, which mandates insurance companies to deposit guarantees with the bank. Additionally, Minister of Labor Mr. Mustafa Bayram raised the ceiling for certificates of deposit for individuals and companies, strengthening the bank’s capacity to support low- and middle-income families.

Internationally, we have built strategic partnerships with reputable organizations, including the U.S. Agency for International Development (USAID), UN Habitat, the European Bank for Reconstruction and Development, and the French Development Agency. These partnerships expand funding opportunities under favorable terms, enabling the bank to effectively support Lebanese families and contribute to economic and social stability in the country.

What are the main obstacles facing borrowers, and how can they be addressed?

One of the main challenges lies in administrative complexities associated with real estate records, as the required documentation often hinders borrowers’ ability to access loans. We call upon the Ministry of Finance to take decisive steps to resolve these issues and simplify procedures. Achieving joint cooperation among all relevant stakeholders is essential to overcoming these challenges and enabling Lebanese citizens to secure adequate housing that meets their needs and enhances their social stability.

What does the Excellence Award received by Banque de l’Habitat signify for its position among Arab banking institutions?

Receiving the Excellence Award from the World Union of Arab Bankers is a prestigious honor that reflects recognition of our ongoing efforts. This award, earned among more than 300 Arab banks and financial institutions, underscores our ability to fulfill our commitments and achieve our goals despite economic challenges, further enhancing our leadership position in the Arab banking sector.

What sets Banque de l’Habitat apart from other Lebanese banks, particularly in housing loans?

Banque de l’Habitat distinguishes itself through its exclusive specialization in housing loans, a sector that many Lebanese commercial banks have abandoned due to the current crises.

Furthermore, we have taken proactive steps to ensure transparency and integrity in all our operations. In collaboration with Ms. Joelle Fawaz, Chairwoman of the Legislative and Consultation Committee, we adopted the use of cross-border accounts to ensure that loan funds are transferred in US Dollars through accounts outside Lebanon. This measure enhances the transparency of our operations and ensures the highest levels of financial security for both borrowers and funding institutions, reaffirming our commitment to providing reliable and sustainable solutions that meet long-term needs.