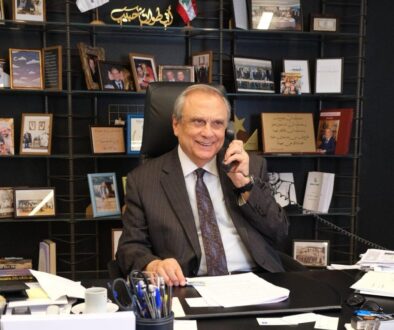

QIIB Chairman and Managing Director, His Excellency Sheikh Dr. Khalid bin Thani bin Abdullah al-Thani announced the bank’s financial results for the first quarter (Q1) that ended on March 31, 2020.

The results, which were announced after a meeting held by the Board of Directors on Wednesday, showed that the bank achieved (at the end of Q1- 2020) a net profit of QR 267.1 million compared to QR 266.1 million for the same period of last year, with a growth rate of 0.4%.

On this occasion, HE Sheikh Khalid bin Thani stated: “QIIB’s positive results in the first quarter clearly indicate that the bank continues to strengthen its financial position and benefit from the strong factors inherent in the Qatari economy, which is one of the best competitive economies in the world”.

He noted, “The challenges that the Qatari economy were able to overcome in the past period enhanced its immunity and strength in the face of new challenges and situations. We, at QIIB, are building on our plans and our short to long strategies, based on this reality. We are all confident that the Qatari economy will continue its outstanding performance in the period ahead under the support and patronage of His Highness the Amir of the State of Qatar, Sheikh Tamim bin Hamad al-Thani”.

Sheikh Dr Khalid said, “In the Q1 of 2020, we continued to focus on the Qatari market and the financing of vital projects related to infrastructure and SMEs. We also adopted the appropriate flexibility in dealing with various market factors while focusing on the prudent management of risk, credit and liquidity. There is no doubt that the results announced today reflect the success that we achieved. We hope we will be to maintain our success in the period ahead, despite the new circumstances”.

“Working incessantly on various vital projects in the country provides a coverage for us and for the banking sector in general to get on to the next stage with confidence. The wise policies of the supervisory authorities will put us on the right track and will ensure continuous growth and achievement of the set goals”.

Sheikh Dr Khalid thanked the QIIB Executive Management and all employees for the results achieved in the first quarter of 2020, stressing that the current circumstances thrust great responsibilities on everyone in order to improve the operational environment and performance to achieve the desired results, serve customers and maximize returns for shareholders.

On his part, QIIB Chief Executive Officer Dr Abdulbasit Ahmed al-Shaibei noted that the bank’s total revenues for Q1-2020 amounted to QR 656.2 million compared to QR 558.1 million at the end of the same period of last year, with a growth rate 17.6%. The bank also improved operational efficiency, which contributed to a decrease in cost to income ratio to be at 20.5%.

He said, “The bank’s total assets increased by the end of the first quarter to QR 60.2 billion with a growth rate of 10.9%, whereas the financing portfolio reached QR 38.5 billion compared to QR 31.0 billion by the end of Q1-2019, with a growth rate of 24.0%.

“The customer’s deposits reached QR 36.3 billion, with a growth rate of 2.9% compared to the same period of last year, the earnings per share reached QR 0.18 while the capital adequacy under Basel III stood at 18.4%, thus reflecting the strength of QIIB’s financial position.”

Dr al-Shaibei noted, “QIIB’s results during the first quarter were consistent with the goals set by the Board of Directors, which are based on making the best use of the great opportunities provided by the Qatari economy in its various sectors. Our planned focus is on the local market. We seek to participate in development plans and benefit from the strength and high solvency of the Qatari economy as well as the opportunities it provides.

He continued: “Our results for the first quarter are consistent with QIIB’s long track record of achieving stable growth rates despite all challenges posed by the market factors. However, hard work and planning helped us adapt to these factors, achieve stability in our operational performance and reduce risks to a minimum.

QIIB CEO noted, “During the first quarter of 2020, the bank continued to invest in and focus on strengthening its technological infrastructure and developing its alternative channels, which enhances the bank’s provision of smart services and facilitates the fulfilment of the customers’ banking needs, without having them visit the bank branches”.

In this context, Dr Al-Shaibei said, “QIIB recently launched its upgraded version of the Online Corporate Banking Platform, which helps the bank’s corporate customers obtain a wide range of services without the need to visit the bank’s branches. The bank also started adopting and using ‘IBM safer payment solution’ in order to strengthen its cross channel fraud prevention systems and allow customers to conduct their banking transactions in a safe and reliable manner”.

Dr Al-Shaibei pointed out that QIIB recently started applying the SWIFT GPI payment system, which is considered one of the latest globally adopted systems in this field, thus becoming the first Islamic bank in Qatar to use this. The bank also launched a new ‘QIIB Points Portal’, developed as part of the bank’s strategic partnership with Mastercard.

He stressed, “QIIB’s investment in technological solutions and alternative channels proved to be useful in the current situation, as the business continuity plan was implemented smoothly and customers were able to obtain most banking services without the need to visit the bank’s branches. This enabled us to achieve outstanding efficiency in facing the emerging circumstances”.

The CEO expressed his optimism that the positive environment facilitated by the Qatari economy and the numerous infrastructure projects and mega projects provide stable growth for the various sectors and help avoid any repercussions resulting from the various factors and conditions.

“We look forward to continuing our good performance and achieving the set goals”.

Dr Al-Shaibei affirmed that QIIB’s strategy will continue to focus on the local market in the forthcoming period as it proved to be very useful, without overlooking promising external investment opportunities that offer high returns and involve low risks.

In the field of human resources, he said, “The bank pays special attention to increasing its operating efficiency by attracting new employees with experiences and talents, namely female and male Qataris. “We will continue to provide comprehensive training and qualification programmes as well as career advancement opportunities that enable and equip them to take up leadership positions in the bank in future.”