By Union of Arab Banks Research Department

Introduction

The Covid-19 outbreak caused an economic hardship for many industries and businesses across the globe. In just a few months, the COVID-19 crisis has brought about years of change in the way companies in all sectors conduct business. Technology sector wasn’t an exception and the pandemic had a significant impact on the industry as well. From impacts on raw materials supply, to disruption to the electronics value chain, to inflationary risk on products. On a positive note, the disruption has caused an acceleration of remote working, and a rapid focus on evaluating and de-risking the end-to-end value chain. In addition, there may be potential carbon emission reductions, which could result in renewed focus on sustainability practices.

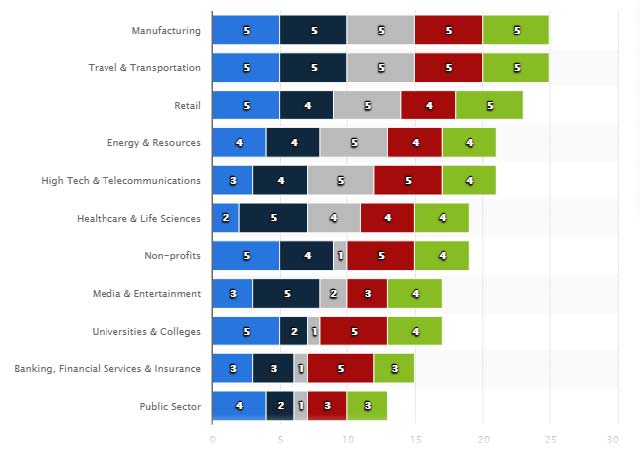

The pandemic forever changed the business and office culture, remote working has been integrated everywhere, and now it is no longer a problem, as companies and employees already adapted. In addition, there was a positive side as well in tech industry, as the business world went through digitalized transformation, which is impossible without technology involvement. Below the Statista’s graph highlights the industries and their components (Personnel, Operations, Supply chain, Revenue) affected by Covid-19.

Projected coronavirus (COVID-19) impact index by industry and dimension – minor (1) to severe (5) in 2020

For the High Tech and Telecommunications Industry, the evaluation is:

- Personnel -3

- Operations- 4

- Supply Chain- 5

- Revenue-5

- Overall Assesment-4

Apple

- Revenue (TTM): $268.0 billion

- Net Income (TTM): $57.2 billion

- Market Cap: $1.4 trillion

- 1-Year Trailing Total Return: 59.8%

- Exchange: Nasdaq

The COVID-19 pandemic acutely hit Apple’s device production and device sales in affected countries like China, Italy, South Korea, the United States, as many of Apple’s suppliers in those countries were forced to shut down production for several weeks in early February 2020.

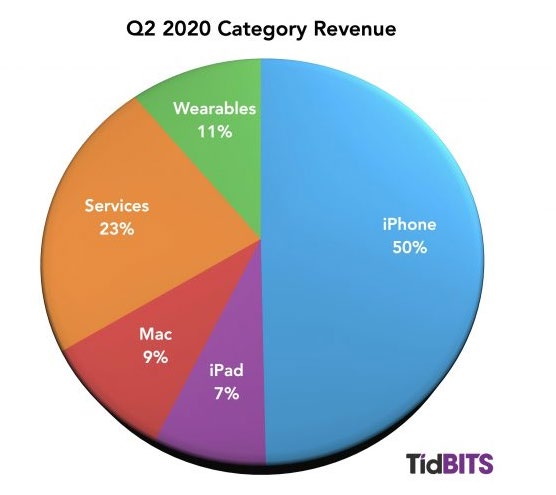

Apple had a record fiscal year and doubled its stock last year, despite the store closures around the world, supply chain disruptions and strained finances for many customers. Apple announced net profits of $11.25 billion ($2.55 per diluted share) on revenues of $58.3 billion (Q2, 2020). The company’s revenues were up 1% compared to the year-ago quarter with profits up by 4%.

The shift to remote working and learning led to the rise in Macs and Ipads sales, as it became essential for people, who were at their homes. According to MarketWatch’s research, Apple’s $9.03 billion in Mac revenue during the September quarter 2020 became a new company record. The Mac business had been stable flat from fiscal years 2017 to 2019, but rebounded sharply during the COVID-19 crisis, with each of the last three quarters sporting revenue growth of more than 20%. The iPad business saw its own revival, growing revenue by of 31% in each of the past three quarters, led by a 46% increase in the back-to-school September quarter.

As stated by Tim Cook (CEO of Apple) Apple’s growth was driven by an all-time record in Services and a quarterly record for Wearables.

Samsung Electronics Co.

- Revenue (TTM): $197.5 billion

- Net Income (TTM): $18.4 billion

- Market Cap: $325.4 billion

- 1-Year Trailing Total Return: 17.2%

- Exchange: Korean Stock Exchange

Despite the continuous challenges from the COVID-19 pandemic, company-wide efforts to ensure a stable supply of products and services globally helped Samsung’s fourth-quarter results. As Samsung states, the profit rose 26.4 % year-on-year led by the display and memory chip businesses but fell 26.7 % from the third quarter due to weaker memory prices and sluggish consumer products sales, as well as higher marketing costs and a negative impact from the Korean won’s appreciation. For the entire year, Samsung made KRW 236.81 trillion in revenue and KRW 35.99 trillion in operating profit.

The Memory Business earnings had a decline quarter-on-quarter despite solid shipments, weighed down by a continued decline in chip prices, the won’s strength, and initial costs from new production lines. In addition, the Mobile Communications Business posted a QOQ decline in profit due to weaker sales and higher marketing spending. On the contrary, the profit from the Display Panel Business grew significantly both QOQ and YoY, thanks to a sharp growth in the mobile display production and improved demand in the large panel market. The Networks Business saw improved earnings owing to the 5G service expansion in Korea and continuing 4G/5G rollouts globally. The Consumer Electronics Division reported a quarterly fall in profit, as increased costs outweighed stronger year-end sales in developed markets.

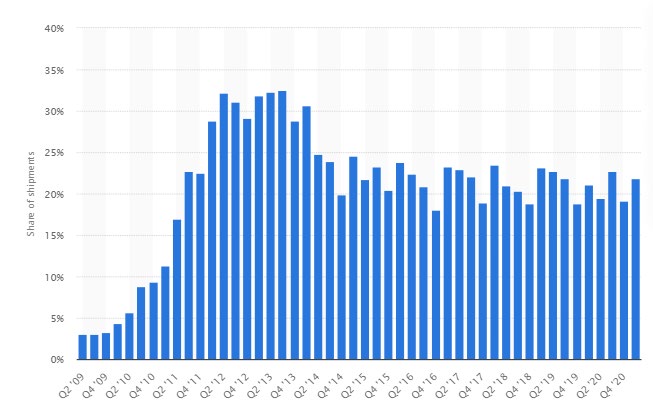

Samsung continues to be a leader in the global smartphone market. In the first quarter of 2021, Samsung held a global smartphone market share of 21.8 %.

Alphabet Inc.

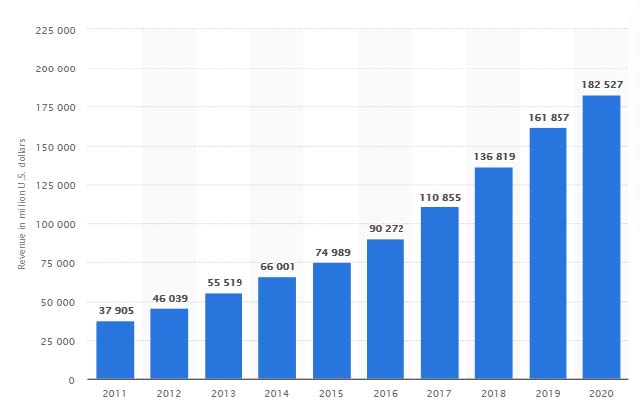

- Revenue (TTM): $182.53 billion

- Net Income (TTM): $40.27 billion

- 1-Year Trailing Total Return: 77.51%

- Exchange: Nasdaq

As Statista mentions, in the most recently reported fiscal year, Alphabet’s operating income amounted to 41.2 billion U.S. dollars, up from 34.2 billion U.S. dollars in 2019. The company’s 2020 net income amounted to 40.3 billion U.S. dollars. Alphabet’s revenue, which for years had consistently increased by about 20% annually, in 2020 increased by just 12.8%. That marked its slowest growth since 8.5% during the Great Recession in 2009.

According to Reuters, Google’s parent, Alphabet, announced record revenue for the second straight quarter in 2020, despite the pandemic, driving shares up 6% as it topped estimates for both advertising and Cloud sales as customers unleashed budgets for the holidays. Google’s advertising business, including YouTube, accounted for 81% of Alphabet’s $56.9 billion in fourth-quarter sales, which rose 23% compared with a year ago. The Cloud unit also benefited from the pandemic, reaching $3.83 billion in sales ($13.1 billion for the full year), which was up 46% from 2019.

Alphabet’s quarterly profit rose 43% to $15.2 billion, or $22.30 per share, compared with the average estimate of $10.895 billion, or $15.95 per share. In a new disclosure, Alphabet said Google Cloud posted an operating loss of $1.24 billion in the fourth quarter and $5.6 billion for 2020, a 21% wider loss than in 2019.

In 2021, the company expects a $2.1 billion boost to operating results after a new assessment extended the useful life of its servers and networking gear by a year or more.

Google’s lead over the global internet advertising market is shrinking as Amazon becomes a bigger threat and China-focused vendors such as Alibaba enjoy a faster rebound from the pandemic. Last week, research company eMarketer estimated Google will capture 30% of the market in 2021 while increasing sales by 18% to $117 billion.

Microsoft Corporation

- Revenue (TTM): $138.7 billion

- Net Income (TTM): $46.3 billion

- Market Cap: $1.4 trillion

- 1-Year Trailing Total Return: 45.5%2

- Exchange: Nasdaq

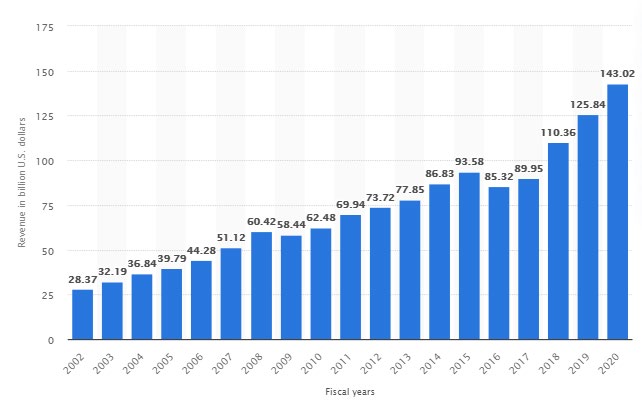

In FY2020, Microsoft generated 143 billion U.S. dollars in revenue, a record year in terms of revenue for the company.

As for other tech companies, for Microsoft as well, it was a challenging year. The company reported total net revenue of $43.08 billion for the quarter ended Dec. 31, 2020, up 17% from $36.91 billion in the prior-year period.

SPG Global research reveals that Microsoft’s intelligent cloud segment revenue grew 23% year over year by reaching to $14.60 billion, with server products and cloud services revenue up 26%, driven by Azure cloud revenue growth of 50%. Also, Microsoft’s CFO Amy Hood mentioned that the company saw fundamental Azure revenue growth in the quarter as well as some reacceleration of growth curves, particularly in industries that had been hit harder in the previous two quarters. Revenue in the more personal computing segment was up 14% to $15.12 billion, with Xbox content and services revenue growing 40%. Hood also said that total gaming revenue increased 51% in the quarter, driven by record engagement and monetization as well as demand for the new Xbox Series X and Series S video game consoles that “significantly exceeded supply.” Microsoft surpassed $5 billion in gaming revenue and $2 billion in revenue from third-party titles for the first time.

Moreover, within the more personal computing segment, Windows OEM revenue increased 1% and Windows commercial products and cloud services revenue increased 10%. Search advertising revenue excluding traffic acquisition costs increased 2%, while surface revenue was up 3%. Meanwhile, revenue in productivity and business processes grew 13% year over year to $13.35 billion, with office products and cloud services revenue up 11% on the commercial side and up 7% on the consumer side. LinkedIn revenue increased 23%, while dynamics products and cloud services revenue were up 39%.

- Revenue (TTM): $85.97 billion

- Net Income (TTM): $29.14 billion

- 1-Year Trailing Total Return: 76.58%

- Exchange: Nasdaq

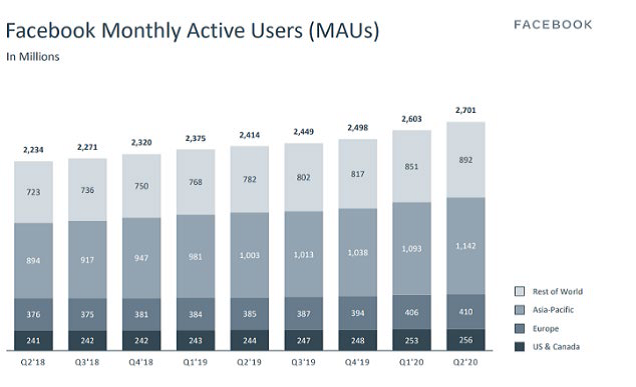

Despite the COVID-19, an advertiser boycott, and an appearance before US officials over possible antitrust violations, Facebook has once again reported steady growth in its latest earnings report, with the platform now exceeding 3 billion users worldwide. In 2020, Facebook added another 100 million monthly active users in Q2, taking it to 2.7b users.

Facebook’s MAU growth rate is directly connected with people, looking for distractions amid the COVID-19 lockdowns start. People started to spend more time on Facebook, by reading news, communicating with friends, and just spending time watching videos and other visuals.

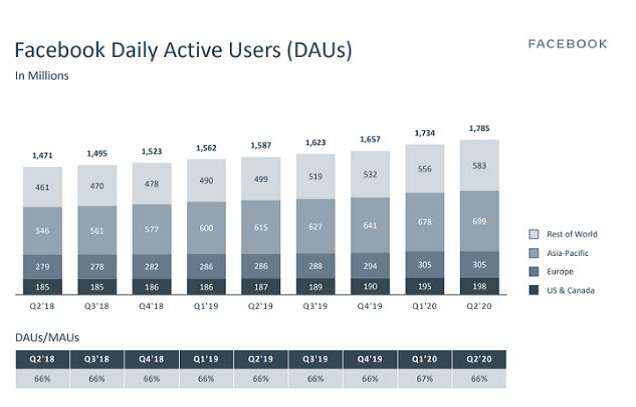

Facebook is now seeing 1.8b individual logins each day. Facebook also continues to see high engagement, with 66% of its monthly active users logging in every day, which has been consistent for several quarters.